does workers comp deduct taxes

This ensures that you are not taxed on both amounts. This deduction allows your workers compensation benefits to be deducted from your income.

Dor Unemployment Compensation State Taxes

Social Security Disability Insurance.

. Here we go. Mandatory workers compensation insurance is normally withheld for employees not independent contractors but the law is a state law and is different in every state. In the eyes of the IRS workers compensation insurance is typically tax-deductible.

You are not subject to claiming workers comp on. Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if theyre paid under a workers compensation act. But there is an exception if youre also getting other disability benefits.

Do You Claim Workers Comp on Taxes. Regarding your question. Workers Compensation Benefits and Your Tax Return.

No taxes are usually not taken out of your workers comp payments. Is workers comp tax deductible. Although workers comp benefits generally are not taxable any retirement benefits youve collected based on your age years of service or prior contributions are not exempt from.

Do you claim workers comp on taxes the answer is no. As an employer you are responsible for the total cost of workers compensation insurance and can deduct the premiums you pay from your. Do you claim workers comp on taxes the answer is no.

You are not subject to claiming workers comp on taxes because you need not pay tax on. For your employees the Internal Revenue Service IRS doesnt allow them to deduct workers comp benefits on their tax returns. 8 hours ago Answer.

The exception says that your. In summary 4850 Time provides up to one year of leave at full. Do you claim workers comp on taxes.

Workmans compensation benefits are non-taxable so you are exempt from having to claim anything you receive in workmans comp on your state or federal income taxes. The OWCP approved a. In addition to the FAQs below employees may call 1-800-736-7401 to hear recorded.

Just like its good practice to protect your employees and your business with workers compensation insurance. Labor Code 4850 provides an extremely valuable benefit for industrially injured workers for one year for each date of injury. Youll want to make sure to keep track of your premium payments and include them at tax time.

How Does Workers Comp Affect a Tax Return. You are not subject to. The cost of workers compensation benefits to the individual employer is based on the gross payroll and the number and severity of illnesses and injuries that type of employer.

Your workers comp wage benefits are generally not subject to state or federal taxes. Whether you receive a lump sum or bi-weekly workers compensation benefit payments it is not considered taxable. Answers to frequently asked questions about workers compensation for employees.

Reporting promptly to the Treasury Inspector General for Tax Administration TIGTA any claims or allegations of workers compensation fraud. One way of looking at workers comp benefits is that they are intended to help cover injured workers. Do you claim workers comp on taxes the answer is no.

No workers comp isnt taxable. Generally speaking you will not be taxed on payments that you receive from workers compensation in your state. The short answer to this question is no taxes are not normally taken out of workers compensation payments.

Under most normal circumstances workers compensation.

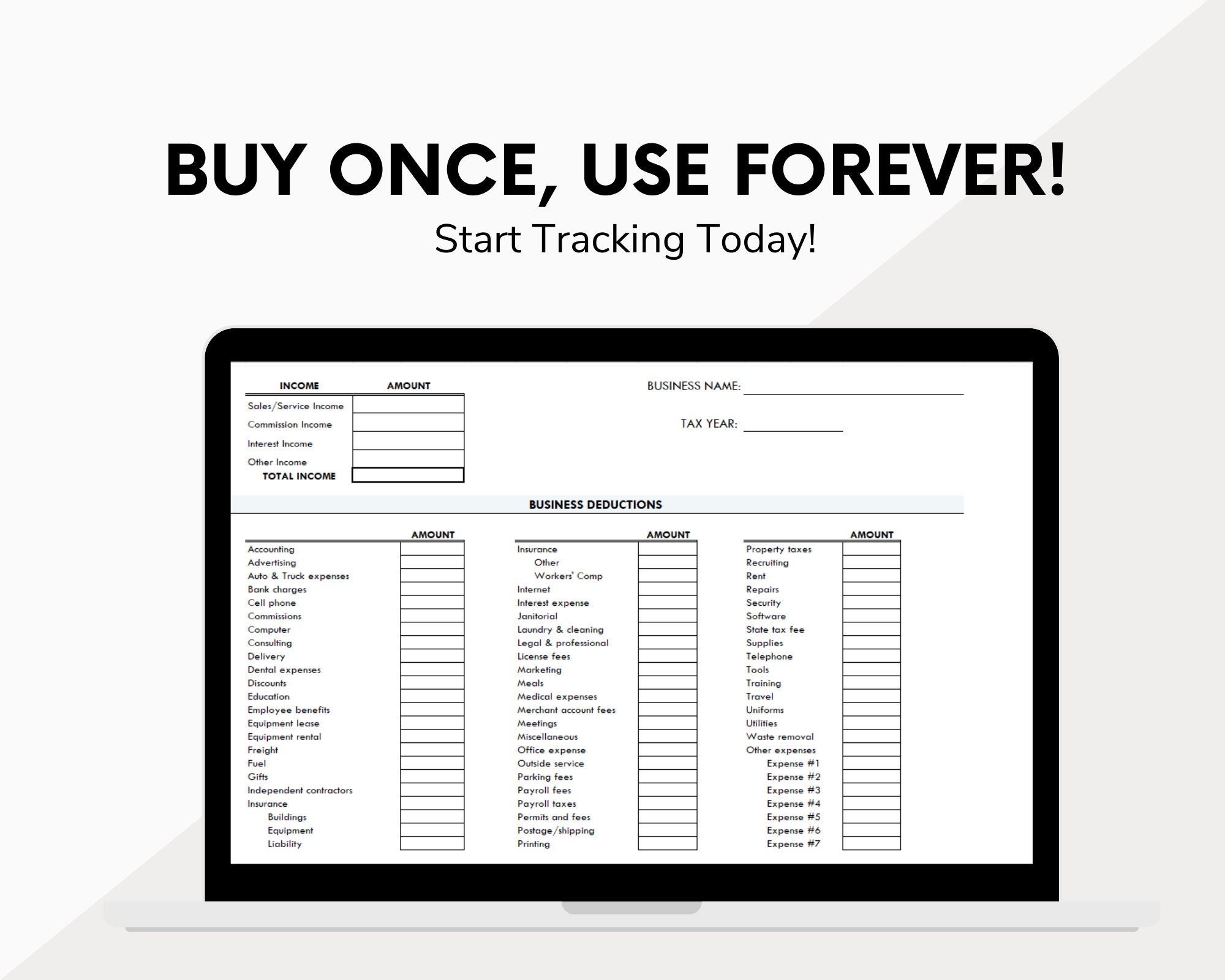

Simple Business Deductions Excel Pdf Tax Deductions List Etsy

Workers Compensation Laws By State Embroker

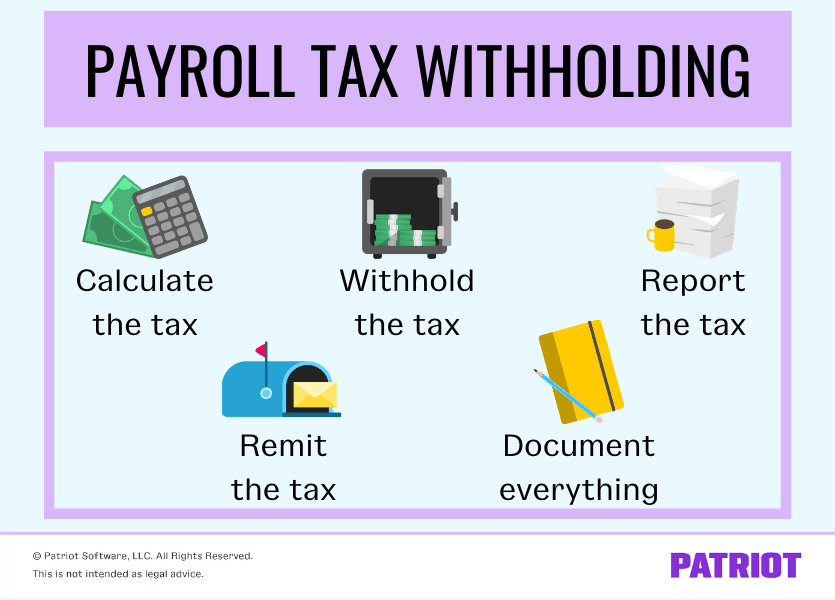

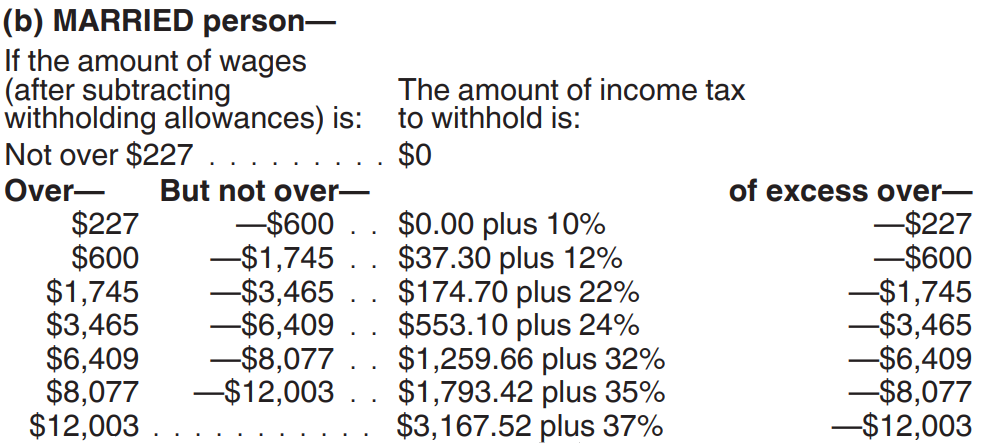

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

Is Workers Comp Taxable An Injury Lawyer Explains

Is Workers Comp Taxable Gordon Gordon Law Firm

Do You Pay Taxes On Workers Comp Simply Business

1099 Employees And Workers Compensation Insurance

Workers Comp Settlement Chart Average Payout Expectations

Workers Compensation And Taxes Phalenlawfirm Com Ks And Molaw Office Of Will Phalen

How Does Workers Comp Affect Taxes Business Com

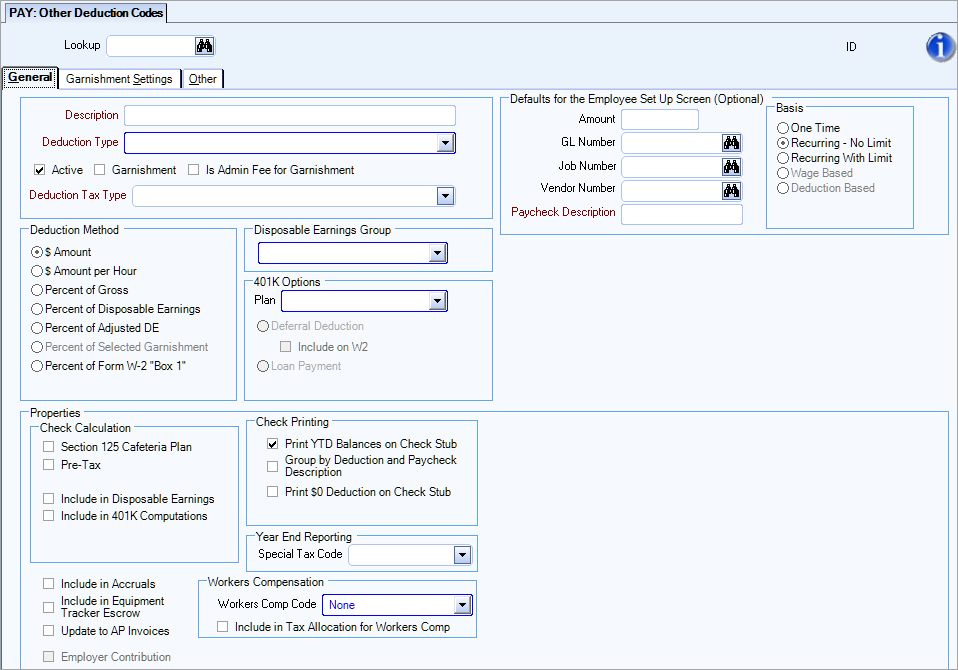

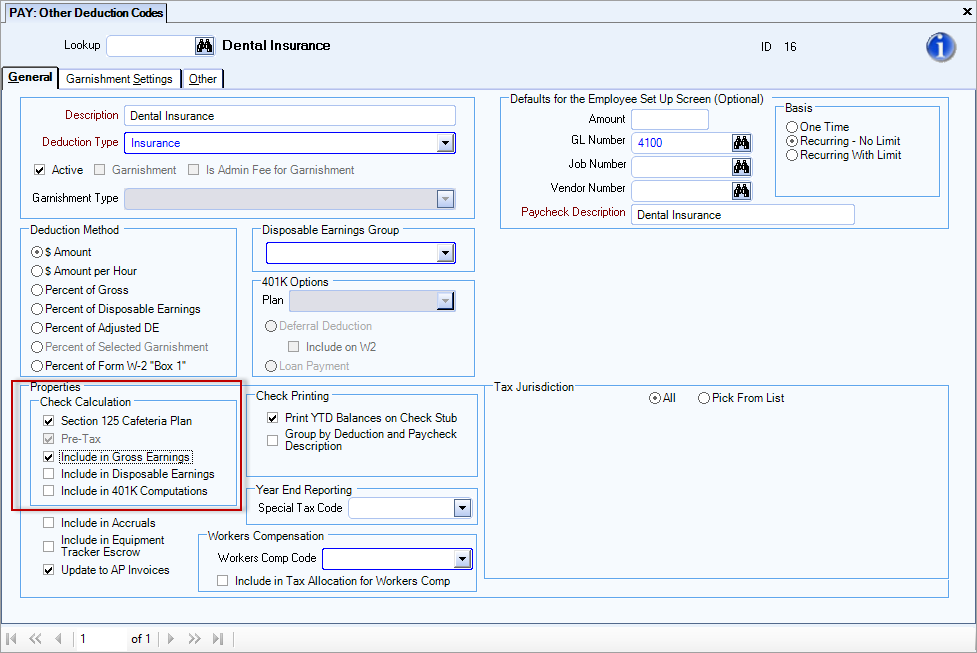

What Are Pre Tax And Post Tax Payroll Deductions Hourly Inc

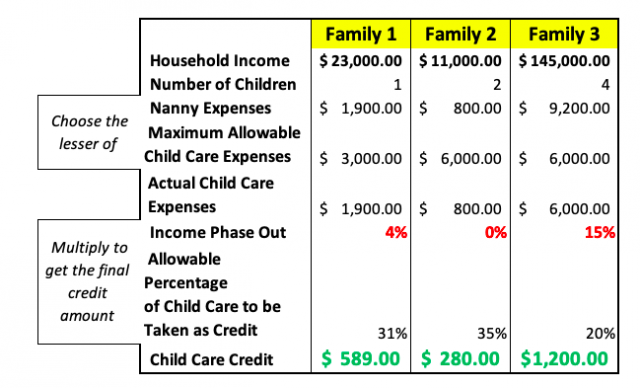

Can I Deduct Nanny Expenses On My Tax Return Taxhub

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Is Workers Compensation Taxable In North Carolina Riddle Brantley

Ohio Workers Compensation Benefits And Income Tax Monast Law Office

How To Avoid Paying Taxes On A Lawsuit Settlement Smartasset